Everyone loves a merger until someone opens the shared drive. Suddenly, the spreadsheets do not match, half the files are named “final_v7,” and the CFO is wondering why there are three versions of the customer database. The headlines make mergers and acquisitions sound glamorous, but anyone who has lived through one knows it is more caffeine than champagne.

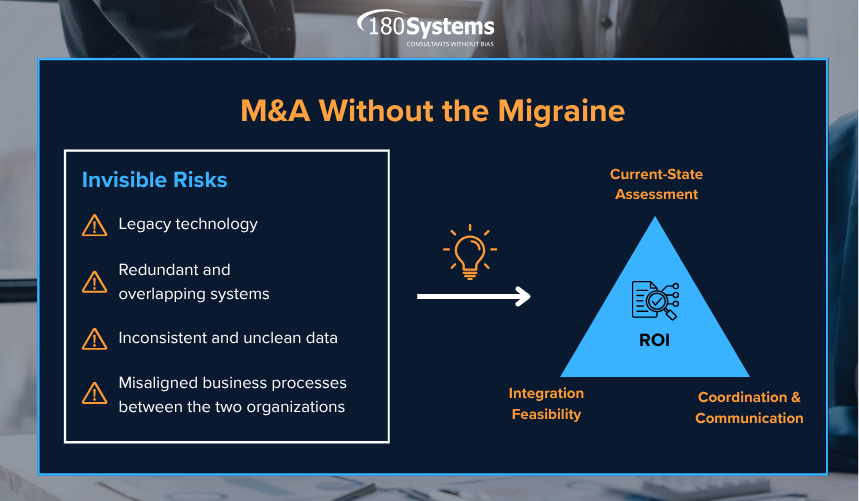

The part that rarely makes the press release is the operational reality. The systems, data, and processes that quietly keep businesses running do not always get along. Integration becomes the invisible risk that can turn an impressive deal into a slow-motion headache. M&A success depends on what happens after the signatures dry, when the spreadsheets meet the servers and the promises meet the process.

Before anyone signs, it helps to lift the hood and see what is really underneath. Every acquisition looks great on paper until someone notices that the target company’s systems are older than the coffee machine. That quiet problem is called technology debt, and it can derail even the cleanest deal model. A solid Current-State Business and Technology Assessment is the difference between optimism and surprise. It identifies what works, what does not, and what will cost more later.

The process starts with a hard look at business strengths and weaknesses, followed by an assessment of the technology that supports them. Reviewing systems such as ERP, CRM, and HRIS exposes redundancies, integration gaps, and compliance risks that do not appear in the glossy due diligence binder. Think of it as a pre-purchase inspection for systems. No one wants to discover a leaking foundation after closing.

Once the current state is clear, the real choices begin. Integrate, replace, or run parallel for a while. Each path has its own cost, risk, and reward. The key is translating those options into something executives can use: a clear return on investment and a roadmap that connects immediate integration tasks to long-term strategy. Efficiency is not about doing things quickly; it is about doing them correctly and only once.

Then comes the post-acquisition shuffle. The ink is dry, the announcement is out, and everyone is ready to “realize synergies.” Meanwhile, IT is quietly trying to merge systems that were never meant to coexist. Integration is not glamorous; it is a grind of aligning processes, cleaning data, and teaching people that the new password policy applies to everyone.

At this stage, success depends on coordination and communication. The people defining the business goals and the people wiring the systems need to understand one another. Integration is a team sport, and clear translation between business and technology prevents most of the drama that keeps executives up at night.

In the end, valuation may create the headlines, but integration creates the results. A successful acquisition is not about how fast it closes; it is about whether the two companies can share systems without muttering under their breath. M&A does not have to be a migraine. With proper preparation and honest assessment, it becomes what it was meant to be: a strategic move that actually works.

Been playing on AR999GameAPK for a few weeks now and I must say, it is an awesome experience! I have been winning some cash as well! Check it out!ar999gameapk

Alright, let’s talk g9777mx. Solid platform, got everything you need for a good time. Games are legit, and I’ve had some pretty sweet wins. Definitely worth a look. g9777mx

Word up, djbajiapp is legit. Nice interface, easy to get around, and some dope tunes while you play. Def check it out. djbajiapp