M&A Advisory and Technology Due Diligence for Deals Where Continuity, Risk, and Value Matter More Than Speed

M&A transactions rarely fail because the deal strategy was wrong. They struggle post-close because technology and operations were misunderstood, risks were hidden in plain sight, and integration decisions were made before the business was fully understood. Our M&A advisory work helps deal teams identify and price risk, protect Day 1 continuity, and make informed integration decisions in transactions across Canada and the US.

How We Support M&A Transactions

As one of the independent M&A advisory firms focused on technology and operations, we advise deal teams at moments of highest uncertainty, where systems, data, and operating dependencies directly affect transaction value, continuity, and integration outcomes.

Our M&A advisory services focus on:

- Identifying and pricing technology and operational risk

- Understanding how systems, data, and processes support the business

- Highlighting dependencies that impact Day 1 and early post-close operations

- Supporting integration planning without disrupting continuity

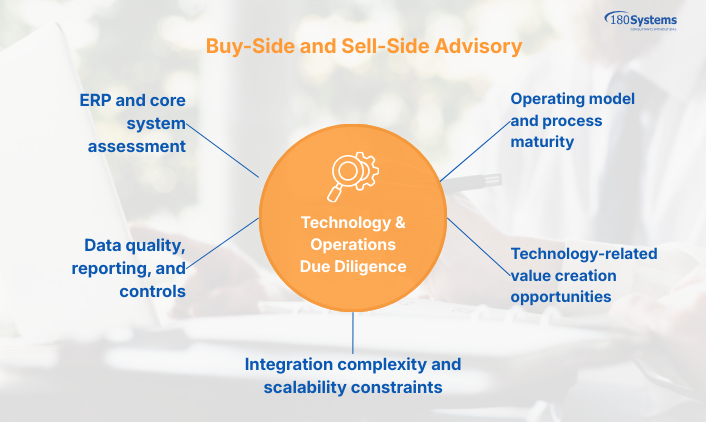

Technology & Operations Due Diligence

Buy-Side and Sell-Side M&A Advisory

We conduct technology due diligence as part of our broader M&A advisory services to help buyers understand what they are acquiring and sellers prepare for scrutiny. Our approach is grounded in how the business actually operates, not theoretical architecture reviews.

Typical technology due diligence scope includes:

- ERP and core system assessment

- Data quality, reporting, and controls

- Integration complexity and scalability constraints

- Operating model and process maturity

- Technology-related value creation opportunities

Our diligence outputs are designed to support investment decisions, valuation discussions, and integration planning.

Post-Close Discovery & Stabilization

Clarity when technology due diligence was constrained

Post-close discovery and stabilization is an M&A advisory service used immediately after a transaction closes, when the buyer owns the business but does not yet have sufficient clarity to safely integrate. This situation most often arises when diligence timelines were compressed, scope was limited, or technology and operations were reviewed by others without an execution lens.

Our role at this stage is not to redesign the business or accelerate transformation. It is to establish control, protect continuity, and create a reliable fact base before irreversible integration decisions are made.

This phase focuses on:

- Confirming what was acquired versus retained across systems, data, vendors, and contracts

- Identifying shared dependencies that create hidden Day 1 and Day 30 risk

- Protecting operational continuity while ownership transitions

- Establishing guardrails that prevent premature system changes or integration missteps

Our role at this stage is not to redesign the business or accelerate transformation. It is to establish control, protect continuity, and create a reliable fact base before irreversible integration decisions are made.

This work reduces surprise risk, prevents premature system changes, and enables informed sequencing decisions grounded in how the business actually operates.

Integration Readiness & PMI Support

Decision support before execution

As part of our M&A advisory services, we support integration readiness by helping deal teams determine what to integrate, when to integrate, and why. Our role is to structure integration sequencing and risk mitigation before execution begins.

This typically includes:

- Integration sequencing and dependency mapping

- Identification of high-risk changes to defer

- Day 1 and early post-close priority definition

- Clean handoff to PMI or implementation teams

We do not lead large-scale system implementations as part of diligence or stabilization. Our role as an M&A advisory firm is to enable informed, low-risk execution.

Value Creation Enablement

Non-transformational, execution-aware

We help deal teams identify practical, near-term value opportunities aligned with the investment thesis and hold-period objectives. This aspect of our M&A advisory focuses on enablement and optimization rather than enterprise transformation.

Examples include:

- Automation opportunities within existing systems

- Reporting and data improvements

- Process simplification and scalability enhancements

- System consolidation opportunities aligned to timing and risk

Who We Work With

Our M&A advisory services primarily support:

– Private equity deal teams

– Corporate development teams

– Portfolio company leadership post-close

Our work is best suited for:

– Middle-market transactions

– Situations where continuity and risk management matter more than speed

Working Alongside Your Deal Team

We work alongside financial, legal, and tax advisors to ensure technology and operations risks are understood and appropriately addressed. Our role complements financial diligence and helps translate findings into operational reality.

Technology risk is not fully covered in financial diligence

Integration complexity is underestimated

Buyers want independent, implementation-agnostic advice

Frequently Asked Questions

What is Technology Due Diligence in M&A?

Technology due diligence evaluates how systems, data, and processes support the business and how they impact transaction risk, integration complexity, and value creation. It is a core component of effective M&A advisory services.

When should post-close discovery be done?

Immediately after close, particularly when diligence was limited or assumptions need validation before integration decisions are made.

How is this different from PMI?

Diligence and post-close discovery inform decisions; PMI executes them. Our M&A advisory work focuses on clarity and sequencing before execution begins.

Do you implement systems as part of diligence?

We do not implement or resell software during diligence, but post-close we support technology integration and implementation as project managers and advisors alongside vendors and internal teams.

Working Alongside Your Deal Team

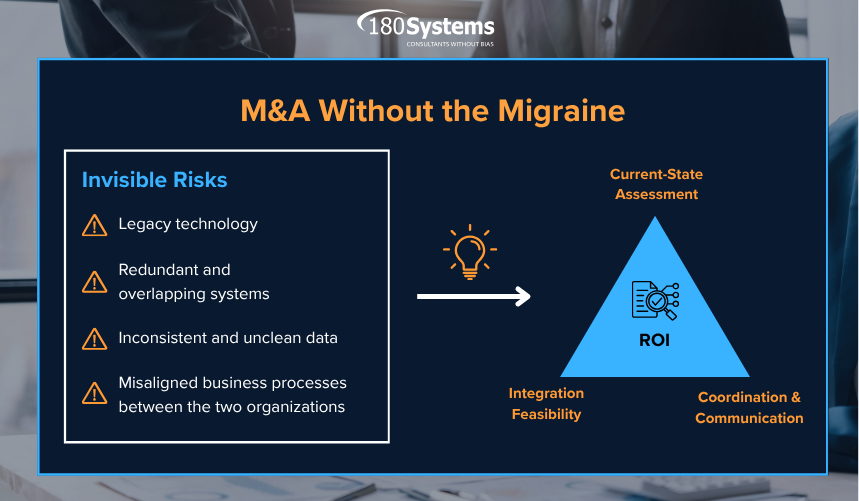

M&A Without the Migraine

Everyone loves a merger until someone opens the shared drive. Suddenly, the spreadsheets do not match...

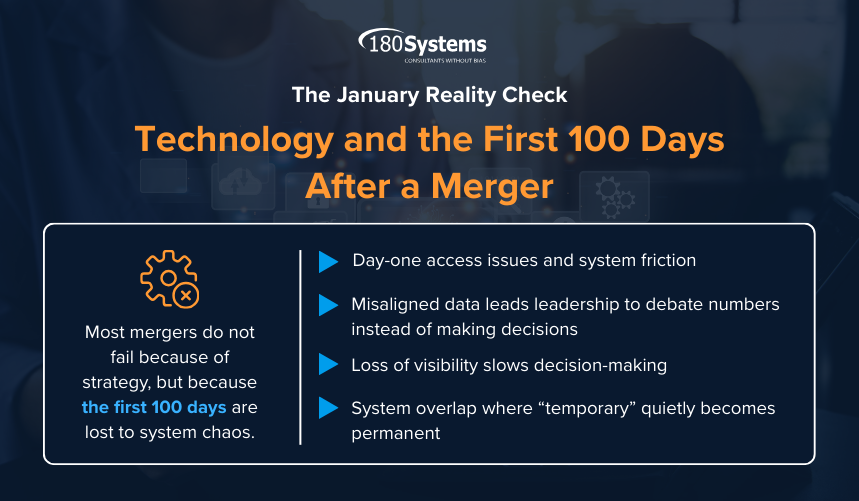

The January Reality Check: Technology and the First 100 Days After a Merger

January has a way of sobering everyone up. The decorations come down, inboxes refill...

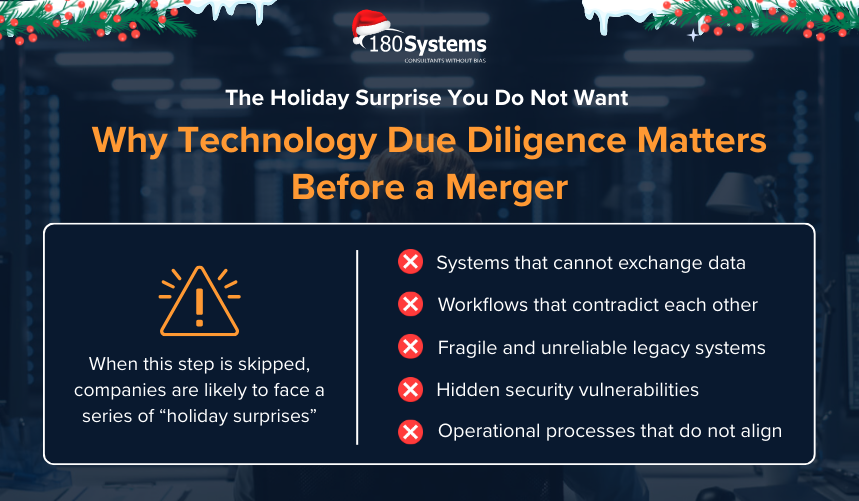

The Holiday Surprise You Do Not Want: Why Technology Due Diligence Matters Before a Merger

Some consultants will identify the top 10 ERP systems or just consider them...