Mergers often feel like the corporate version of the holidays. There is excitement, anticipation, big plans, and the optimistic belief that everything will come together beautifully. But just like the holidays, the part that looks magical on the outside usually hides a fair amount of scrambling behind the scenes.

And while leaders gather around the deal table making lists and checking them twice, technology due diligence somehow gets treated like the last-minute gift someone remembers on the way to the party. A quick stop, a rushed decision, and a hope that everything works out. Spoiler alert: it usually does not.

Technology due diligence is the difference between a merger that feels like a well-planned celebration and one that feels like discovering burnt stuffing in the oven after the guests arrive. It may not be glamorous, but it keeps the whole event from falling apart.

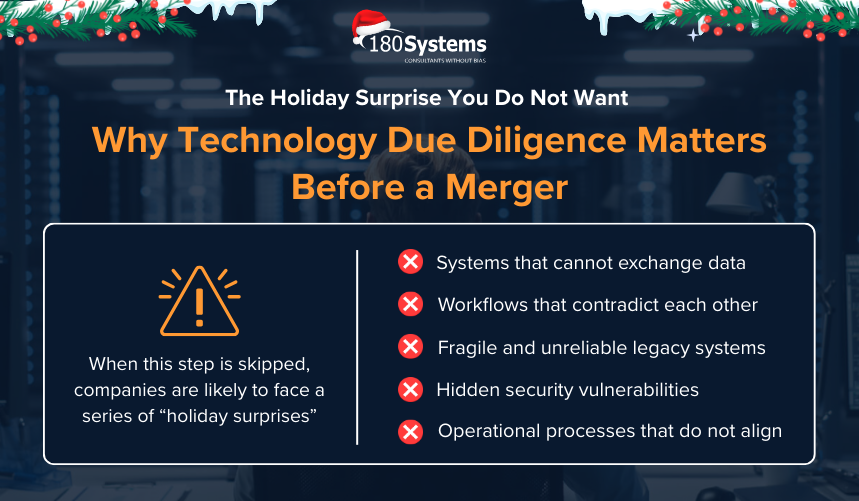

Skipping it is the first step toward a very messy morning-after. Imagine pulling two companies together only to realize their systems cannot exchange data, their workflows contradict each other, and their systems belongs on the naughty list. That kind of surprise drains enthusiasm faster than holiday lights drain a power grid.

Legacy systems bring their own brand of holiday chaos. They might still function, but they are fragile and unpredictable. One company might rely on a modern cloud solution, while the other is holding onto a server that sounds like it needs a warm blanket and a good retirement plan. When those worlds collide without preparation, the cost of keeping everything running quietly eats the budget that was supposed to deliver “synergies.”

Security risk is another festive surprise no one wants. Acquiring a company means inheriting every outdated patch, every forgotten permission, and every system that has not been updated since the last time someone decorated an office tree. Once networks are connected, those gaps multiply. The integration that was supposed to create efficiency can unintentionally turn into an open invitation for trouble.

Even operational processes get caught in the holiday shuffle. One company’s approval workflow might resemble a clean checklist, while the other’s involves three emails, two spreadsheets, and a hope that someone remembers the final step. Without upfront clarity, post-merger teams find themselves debating whose process is the “real” one, while productivity quietly slips away.

Technology due diligence prevents this type of seasonal chaos. It gives executives a clear picture of systems, risks, and integration requirements before the deal closes. It exposes redundancies, highlights data issues, and uncovers the hidden tasks that need to happen long before two companies exchange their first holiday card as a merged entity.

The real value is predictability. When leaders understand what technology work lies ahead, they can plan timelines, budgets, and resources realistically. Integration becomes a managed transition instead of a frantic scramble. IT teams can prepare. Finance teams can forecast. Operations can adapt. And everyone can stay focused on creating value instead of putting out fires.

A merger without technology due diligence is like hosting a dinner and discovering the main dish is still frozen; it becomes improvisation, not celebration. Everything may look perfectly set on the surface, but the moment the work begins, the cracks appear. Clean data, stable systems, and clear processes are what keep a merger steady. They are the quiet ingredients that make the entire effort come together smoothly.

In the end, technology due diligence is the thoughtful preparation that protects the deal. It ensures the optimism of the season carries into the new year rather than becoming a cautionary tale. The best mergers are the ones that deliver predictable results long after the celebratory toast fades. With the right groundwork, even the most complex integration can feel as smooth as the first snowfall.

Invite your network, boost your income—sign up for our affiliate program now!

I’m digging the 2ez.bet community! Great place to chat strats and share wins which is always awesome. Nice for active sports bettors. Find the community at 2ez.bet community.

Spintime PH! Is this legit or just another scam? Taking a small leap of faith here. Check for yourself: spintime ph

Been using 2ez bet for a little while now. I found some good deals on the sports I like. Give them a shot and see for yourself, and join their community 2ez bet.

Unlock top-tier commissions—become our affiliate partner now!

Jilino1Live’s got a good variety of games. I especially like their tournaments. A bit competitive, but fun! Check it out: jilino1live

DG99Calendar keeps you updated on all the promo events. Very useful for planning your play. Link: dg99calendar

MS88Slot, not the best, not the worst. Decent for a quick spin now and then. You might get lucky! Here’s where to find it: ms88slot

Bongdalu601 is my go-to for football news and analysis. Been using it for ages. Check out bongdalu601 if you’re a serious football fan.

Looking for some insider tips on horse racing? Nesine’s got your back with helpful commentary. Get the edge here: nesine at yarışı yorum

Where can I find the OKBET app download APK? Gotta sideload it or what? Getting ready to install the okbet app download apk.